How The Mellon Family Really Got So Rich

According to Forbes, the Mellons are known as one of the top 30 richest families in the United States and can boast a combined net worth of around $11.5 billion. Moreover, the Bank of New York Mellon is one of the largest asset managers in the world, with over $1.9 trillion in its custody, says Investopedia. However, their family history had a much more modest origin.

According to Business Insider, the saga of the Mellon family began with patriarch Thomas Mellon, who was born in 1813 in Northern Ireland and immigrated to Pennsylvania at the age of five to flee the potato famine that had gripped much of the Emerald Isle.

Inspired after reading Benjamin Franklin's autobiography, Thomas became the first in his family to graduate college and opened up a private legal practice in Pittsburgh. However, he had an eye for more than the law and began making investments in both coal mines and real estate in Pittsburgh, thanks to his income as a lawyer and his wife's family money.

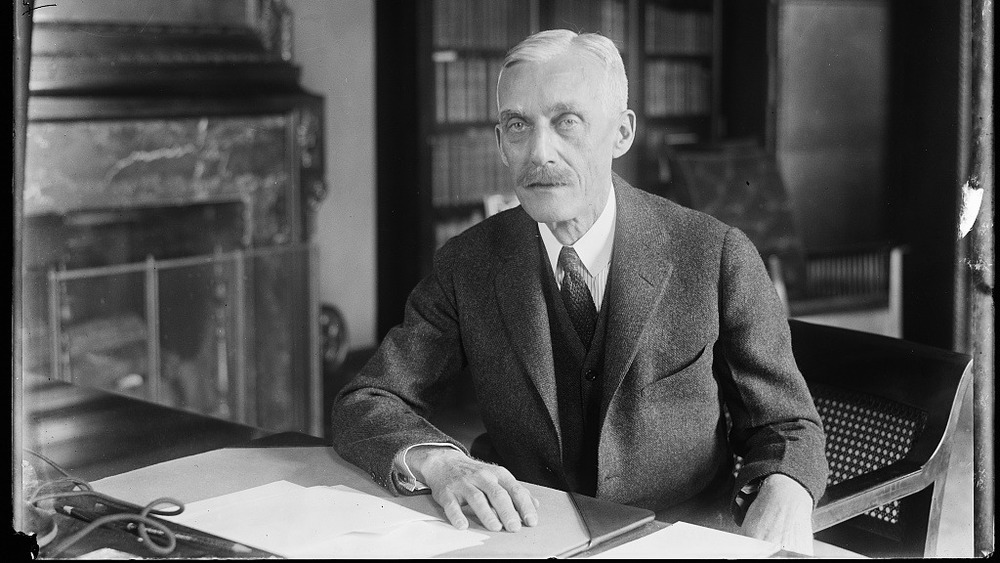

Mellon's investments paid off as demand for coal soared during the Industrial Revolution and the real estate market in Pittsburgh doubled within the span of a decade. In fact, he was so successful that he decided to move into another industry: banking. In 1869, Mellon opened his own bank, T. Mellon & Sons, which quickly multiplied the family's fortune — especially under the leadership of his son Andrew (pictured above).

Thomas's sons, particularly Andrew, took their wealth to another level

In 1882, Thomas retired and left his banking business to two of his sons, Andrew and Richard. The pair often operated by providing financial assistance to companies, which in turn gave the Mellons either control or influence in these businesses.

For example, Andrew and Richard offered a loan to the struggling Pittsburgh Reduction Company in 1889. This move was wildly lucrative after the company developed a patent on processing aluminum and claimed a virtual monopoly on aluminum in North America. Andrew took control of the company in 1907 and changed its name to the Aluminum Company of America, or ALCOA.

Andrew achieved particular wealth and fame, thanks to investments in companies such as Gulf Oil, which Andrew eventually bought out in 1907. Gulf Oil was sold to Chevron in 1984 for $13.3 billion. In addition, Andrew founded Union Steel in a partnership with Henry Clay Frick, another leader of the Industrial Revolution. Union Steel later merged with U.S. Steel to become the largest steel company in the world. The Mellons also invested in other operations, including whiskey, shipbuilding, and manufacturing. The legacy of diverse investments lives on today, with more recent family members involved in computer programming and virtual currency enterprises.

Matthew Mellon recently revealed to Forbes his family's mantra for remaining up-to-date with the changing economic landscape: "Intuition is the number one tool in the toolbox," he explained.