The Charges Against FTX Founder Sam Bankman-Fried Explained

Known as the "King of Crypto," the BBC writes that Sam Bankman-Fried created and destroyed a multi-billion empire in the span of a few years. The 30-year-old is a former Massachusetts Institute of Technology (MIT) student and stock trader that delved into selling Bitcoin. According to Forbes, Bankman-Fried used the money he earned from this business venture to launch Alameda Research, a cryptocurrency trading firm, in 2017. Then in 2019, he established FTX, a cryptocurrency exchange platform (per NBC News). CNN states that these efforts generated Bankman-Fried a massive net worth of $16 billion. However, it all came crashing down in December 2022.

Per The New York Times, on December 12, Bankman-Fried was arrested in the Bahamas and indicted on eight criminal charges by the Southern District of New York. The Guardian explains that this includes fraud, conspiracy to commit money laundering, and conspiracy to defraud the U.S. and violate campaign finance laws. Furthermore, the Securities and Exchange Commission (SEC) filed civil charges against him. Gary Gensler from the SEC announced, "We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto." NBC News notes that Bankman-Fried's legal woes came shortly after the disintegration of his FTX company.

The collapse of FTX

NBC News explains that FTX was used to sell and trade cryptocurrency. It also created its own digital currency called FTT. Needless to say, the company quickly skyrocketed, and The Wall Street Journal reported that FTX was endorsed by big names like football star Tom Brady, amongst others. Things, however, went awry in November 2022 when the company filed for bankruptcy (via The New York Times). This occurred within days after an Alameda Research balance sheet was leaked on CoinDesk. In simple terms, it revealed that Bankman-Fried was mishandling his customers' funds (per Reuters). Investors removed their funds from FTX, causing the company to incur an $8 billion debt.

As a result, a different article from The New York Times writes that FTX and Bankman-Fried's net worth imploded. The company filed for bankruptcy, and Bankman-Fried resigned and was replaced by John Jay Ray III. Ray noted that FTX had attempted to "conceal the misuse of customer funds." There was a glimmer of hope when Binance, another cryptocurrency exchange platform, announced that it would purchase and save FTX, but it later pulled out of the deal when it concluded that FTX had indeed mismanaged funds. That being said, things only worsened when the Justice Department and the SEC got involved and began an investigation into FTX.

The connection between Alameda Research and FTX

According to The Guardian, several of the eight charges against Sam Bankman-Fried revolve around his firm, Alameda Research. CNBC writes that he used the money invested in FTX to fund his other company. It seems that Bankman-Fried placed so much of this capital into Alameda Research that his FTX customers were unable to cash out if they wanted to. This, of course, is not allowed. In other words, Alameda Research was not holding money as it should and was using FTX as backing. Per The New York Times, Bankman-Fried admitted that Alameda Research had borrowed money from FTX and said, "It was substantially larger than I had thought it was."

The Guardian states that prosecutors allege that Bankman-Fried used FTX funds to pay for Alameda Research's debts. Moreover, they claim that he used the funds for Alameda's expenses and, as a result, defrauded his inventors by not disclosing this information and the company's finances (via CNN). Another article from The Guardian explains that Bankman-Fried is a big political donor for the Democratic Party, and Insider notes that he provided them with $40 million to advance cryptocurrency's role in politics. However, he later revealed that he had donated "the same amount" to the Republican Party (per The Guardian). Prosecutors allege that he may have breached laws on political donations in an effort to lobby for cryptocurrency.

Sam Bankman-Fried defrauded investors out of $1.8 billion

Besides the eight criminal charges against Bankman-Fried, CNN writes that the SEC brought up a civil suit against him. According to The Guardian, they allege that the charges against him stem from "orchestrating a scheme to defraud equity investors in FTX." In addition, the SEC claimed that he may have used up to $1.8 billion dollars from FTX investors into Alameda Research. They allege that Bankman-Fried used these funds "to make undisclosed venture investments, lavish real estate purchases, and large political donations." They added that there is a possibility that Bankman-Fried will face more charges as they note that the investigation is "ongoing."

According to CNBC, Bankman-Fried was also charged by the Commodity Futures Trading Commission (CFTC). They allege that he violated the Commodities Exchange Act, which regulates the trade of commodities. The CFTC states that Bankman-Fried "accessed and used FTX customer funds for Alameda's own operations and activities, including to fund its trading, investment, and borrowing/lending activities." Per CoinDesk, the CFTC claims that Bankman-Fried's fraudulent activities ultimately affected the price point of cryptocurrencies like Bitcoin, which are classified as commodities. The CFTC also warned, "We will work tirelessly to use the full scope of our enforcement authority to hold such fraudsters accountable."

He faces years in prison

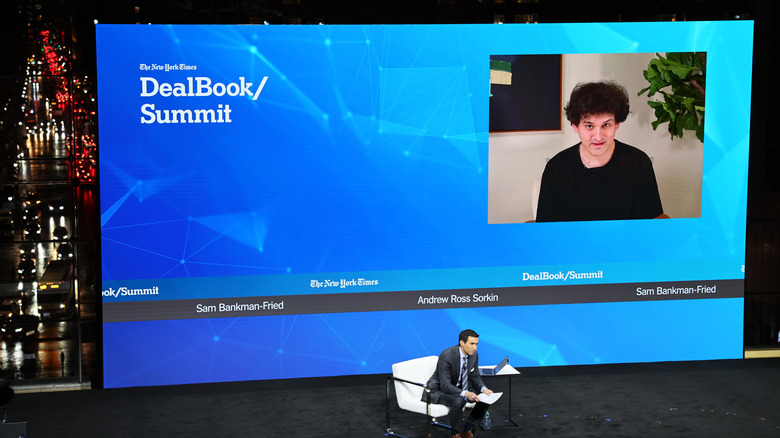

CNN reported that in December 2022, Sam Bankman-Fried was going to testify about FTX's downfall for the House Financial Services Committee. In his words, he was going to "shed what light I can" about his company's collapse. The publication notes that the committee wanted answers regarding the allegations of mishandled funds. Instead, Bankman-Fried was arrested, per The New York Times. However, John Jay Ray III decided to testify and said he was appalled by "such an utter failure of corporate controls at every level of an organization." At the time of his arrest, Bankman-Fried lived in the Bahamas. Reuters reported that he would likely be extradited to the United States.

The Guardian explains that the United States and the Bahamas have an extradition treaty. However, it's possible that Bankman-Fried will fight his extradition and possibly prolong legal proceedings. In any case, if he cooperates, Bankman-Fried will likely return to the United States in a few weeks. According to CNBC, if convicted, Bankman-Fried will no doubt spend years in prison. However, former federal prosecutor Renato Mariotti told CNBC that the scope of Bankman-Fried's crimes means that a trial will not occur for some time. He said, "The more that they charge, the bigger that the case is, the more time they're going to need to get in motion."

Sam Bankman-Fried's thoughts on his situation

According to The Guardian, Sam Bankman-Fried has been openly talking to the media about FTX's bankruptcy and his legal problems. Days before his arrest, Bankman-Fried spoke to the BBC and admitted that he had made mistakes with FTX and Alameda Research. In addition, he took the blame for mishandling his company's funds and divulged that he hoped to pay his investors back one day. He stated (per the BBC), "I didn't knowingly commit fraud, I don't think I committed fraud, I didn't want any of this to happen. I was certainly not nearly as competent as I thought I was."

In an interview with The New York Times, Bankman-Fried once again took responsibility for FTX's downfall but added that he did not know his company's discrepancies. He stated, "I had a duty. I had a duty to all of our stakeholders, to our customers, our creditors. I had a duty to our employees, to our investors and to the regulators of the world to do right by them and make sure the right things happened at the company. And clearly, I did not do a good job with that." Although Bankman-Fried did not end up testifying for the House Financial Services Committee, Forbes published the statement he had planned on reading. His opening sentence states, "I f***** up."