Why Is College So Expensive?

According to 2019 estimates from the National Center for Education Statistics, the cost of attending a four-year public college or university in the U.S. during the 1985-1986 school year was $3,859 when adjusted for inflation. By the 2015-2016 school year, the cost had rocketed to a daunting $19,488. Meanwhile, the average price tag at private institutions ballooned from $9,228 to $39,534. If you thought the cost of higher learning was offset by higher-paying jobs for graduates, think again. Forbes reports that since the late 1980s, the price of college has risen nearly eight times faster than average wages.

Rapidly rising costs are turning higher institutions into lessons in destitution. Citing financial aid applications, a 2019 report by CBS found that more than 68,000 students said they were homeless. DePaul University student Dom Coronel funded his studies with scholarships, loans, and financial aid but still found himself living in a homeless shelter, sleeping in parks and forests, and occasionally eating out of trash cans.

What was once considered the best time of your life has become a debt sentence. In 2019, more than 3 million people over the age of 60 were still paying off over $86 billion in student loans, per CBS. Overall, more than 44 million Americans had outstanding student loan debt totaling over $1.75 trillion, according to the Education Data Initiative. This financial albatross can make paying for basic necessities next-to-impossible. How did higher education become so horribly unaffordable?

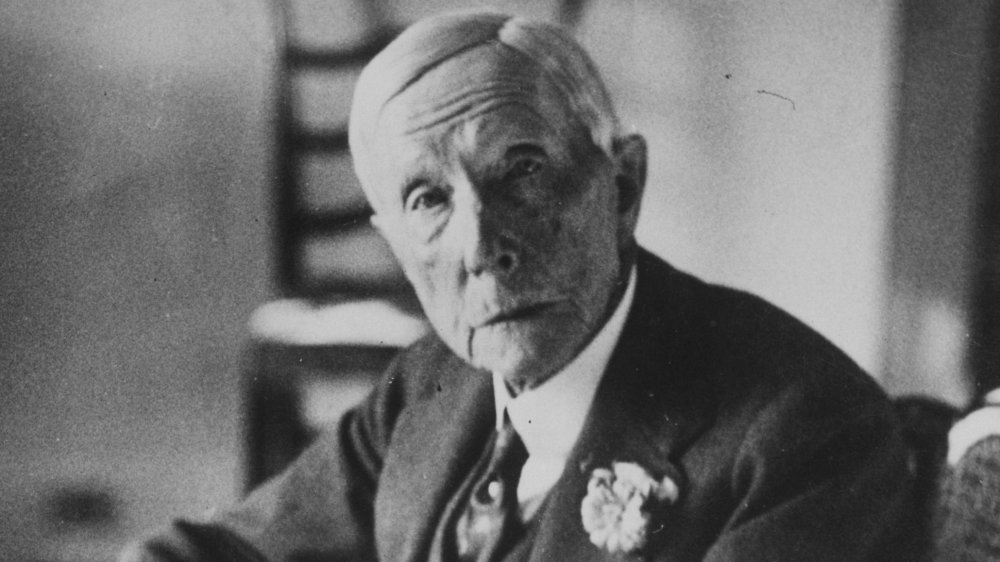

A billionaire campaigned to kill tuition-free college programs

Prior to the 1900s, college was largely costless for students. In the minds of 19th century Americans, higher education served the greater good. As detailed by Thomas Adam, a professor of transnational history at the University of Texas Arlington, graduates generally trained to become teachers, preachers, and leaders in their communities. As a result, colleges were "considered a public good," and "society was willing to pay for it." This typically happened in one of two ways: institutions didn't charge tuition or students received scholarships.

So what changed? In the 1900s, students from well-to-do families flocked to private institutions. They could afford not to take higher education seriously and tended to approach it as a "social experience." Afterward, they "experienced" prestigious jobs, thanks to the swanky degrees they received. As rich kids reaped big benefits, poor kids would pay a steep price. In 1927, oil baron and history's first billionaire John D. Rockefeller waged a campaign to force students to pay for college. Rockefeller argued that higher education had ceased being a public good and was now a personal pursuit. He also championed the student loan system that metastasized into the financial cancer that it is today. Rockefeller's voice was joined by real estate magnate William E. Harmon. Together they urged educators, administrators, and donors to quit covering the tuition of students. Their efforts effectively ended the age of free college in the U.S.

From G.I. to Joe

NPR reports that before 1944, the majority of Americans considered colleges and universities a luxury only wealthy elites could afford. But WWII reshaped the landscape of education. The 1944 G.I. Bill made college more accessible to veterans who otherwise wouldn't have even considered it an option. History explains that servicemen received stipends to pay for college and trade school and additionally benefited from low-rate mortgages, hospitals, and unemployment compensation.

Almost eight million veterans pursued a higher education, a number 10 times higher than what lawmakers anticipated. States were gung-ho about keeping tuition low, and thanks to the robust postwar economy provided ample capital to not only accommodate the influx of servicemen but also open their doors to wider of the general public. The federal government chipped in with the National Defense Student Loan program, later known as the Federal Perkins Loan program, which created another surge in enrollment.

Between 1978 and 2005, then-Delaware Senator and future Vice President Joe Biden would help turn the booming student population into a financial time bomb. As recounted by The Intercept, Biden supported the 1978 Middle Income Student Assistance Act, which erased income restrictions on student loans. That very same year, he also co-authored legislation that prevented students from obtaining bankruptcy protection after graduation. In the 1980s, he supported additional legislation that eliminated more borrower restrictions. Between 1977 and 1989, student loans exploded from $1.8 billion to $12 billion. Then in 2005, Biden championed the catastrophic bankruptcy bill which made discharging student loan debt virtually impossible.

Many job seekers can't afford not to go to college

In 2009, the Chronicle of Higher Education asked experts, "Are too many students going to college?" Associate professor of economics Bryan Caplan answered yes, calling college "usually a drain on our economy and our society." Manhattan Institute senior fellow Marcus Winters disgareed, arguing among other things that the promise of higher wages outweighs the costs. Perhaps a better question is: what's the cost of not going to college?

According to projections by Georgetown University's Center on Education and the Workforce, only 36 percent of job openings won't require education past high school in 2020. Moreover, for decades, Americans without college degrees have seen job opportunities evaporate due to drastic changes to the economy. One of those major changes was the 1994 NAFTA trade deal, which, as the Economic Policy Institute points out, utterly gutted manufacturing jobs that were overwhelmingly held by people without college degrees. Within seven years of NAFTA's ratification, an estimated 766,000 job opportunities for non-college-educated workers had vanished, only to be replaced by lower-paying, less secure positions.

With time, a greater demand for workers in fields like tech and healthcare placed an even greater premium on higher education. 2008's Great Recession exacerbated the situation for non-degree-holders. A 2018 analysis by the Brookings Institution found that the economic woes of 2008 "disproportionately harmed" people with less formal education, and by 2018, they had yet to recover economically. Meanwhile, those with the highest levels of schooling rebounded the most easily.

Low-income students attend worse schools and have worse debt struggles

A 2019 study by the Pew Research Center shows a giant jump in undergraduate enrollments over the previous two decades. This "almost exclusively" reflects an "influx of students from low-income families and students of color." Unfortunately, the majority enroll in America's least selective public four-year schools, for-profit and two-year colleges. Compared to their more selective counterparts, these schools invest less money in teaching students and helping them obtain degrees. Unsurprisingly, they also have worse outcomes overall for enrollees.

An estimated 39 percent of students attending two-year colleges finish in six years. At "minimally selective" four-year insitutions, the number jumps to 67 percent. Many undergraduates at for-profit colleges don't finish at all. They tend to be the most impoverished students and have the most onerous expenses. Sadly, that's partly by design. Tressie McMillan Cottom, a university teacher, author, and former enrollment officer for two for-profit colleges, told NPR that for-profit institutions actively seek applicants "who qualify for the maximum amount of student aid" and charge them 30 to 40 percent more for credentials than public or non-profit alternatives.

According to Cottom, for-profit institutions exploit "the poorest among us," promising to improve their lives only to drown them in a sea of fees. NPR observes that degree earners who attended such schools tend to have the hardest time making loan payments. In a cruelly ironic twist, they pay some of the highest tuition rates for the least valuable degrees. As a result, they earn less on average than other degree-holders and are four times more likely to default on loans than community college graduates.

Deceptive strippers and desperate veterans: the scams of for-profit colleges

In a testament to the stunning corruption that infects segments of the U.S. education system, in 2017, CBS reported than an insane 98.6 percent of all student loan fraud claims for that year were linked to for-profit colleges. That finding came from an analysis of almost 100,000 loan forgiveness claims. In 2010, undercover agents investigated 15 for-profit institutions and found that all of them used deceptive advertising and four encouraged fraud. Florida's now-defunct FastTrain College allegedly went off the rails with its dishonest tactics. Reuters reports that the school was accused of enlisting strippers to dress suggestively and recruit male students. It also accepted ineligible applicants and handed bogus degrees to people who failed to graduate.

For-profit institutions have also targeted veterans for their GI Bill benefits. PBS explains that for-profit colleges are barred from getting more than 90 percent of their revenue from federal aid. However, a legal loophole has enabled them to count the tuition assistance provided through the G.I. bill as private financing. As a result, these schools have "disproportionately profited from enrolling veterans." Among them was Navy veteran Milo Jones, who studied information technology at ITT Technical Institute while working full time to provide for his family. ITT assisted him in applying for G.I. bill benefits and loans. Jones graduated with $40,000 of debt and bad credit.

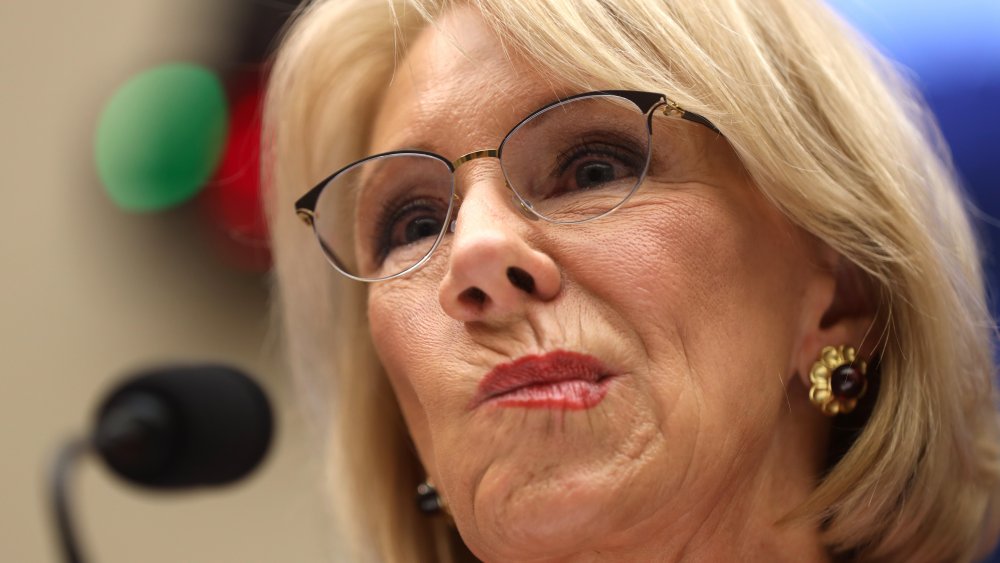

The Education Department made life harder for defrauded students

Before going belly up in 2016 ITT Technical Institute was an apex predator among for-profit colleges. Via Indiana news outlet Fox 59, students accused ITT of making them choose between losing their credits and accepting so-called "temporary credit loans" that charged inflated interest rates and required borrowers to repay them before the following school year. The alleged coercion came in the form of "pulling students out of class or threatening to expel them if they didn't accept the loan terms."

The shameless chicanery of ITT and other predatory schools prompted the Department of Education to issue a memo in 2017 that declared, "it is appropriate for the Department to award eligible borrowers full relief." Yet as NPR details, Education Secretary Betsy DeVos was much less forgiving. She overruled the department and made debt relief dependent on income. DeVo was opposed to forgiving student loans so much that when she had to sign off on claims approved before she took office, she inserted the words "with extreme displeasure" beneath her signature.

In 2019, a federal judge held DeVos in contempt and fined the Education Department $100,000 for demanding loan repayments from 16,000 students and parents who had been defrauded by Corinthian Colleges. That same year, The Intercept reported that the department "quietly" eliminated requirements for-profit colleges to allocate funds as a buffer for bankruptcy. As a result, taxpayers will foot the whole bill for loan refunds while for-profit colleges profit even more. In one case, a school on its last legs actually received $10 million from the Education Department.

Educating students about finances doesn't help

In 2019, the Treasury Department offered its two cents about the $1.5 trillion student debt crisis. Per Market Watch the department proposed mandatory financial literacy courses at colleges and universities. Intuitively, that might seem like a fine solution. This suggests that ignorance is a significant problem. And isn't that the fundamental assumption behind all education anyway? Maybe students are just uneducated about how to better avoid the debt tsunamis that have swept away countless bank accounts. But as any soon-to-be-broke philosophy student can probably tell you, good advice is only useful if you're in a position to follow it.

Market Watch notes that institutions throughout the nation have already tinkered with different methods of educating students on debt. In terms of effectiveness, these programs get an "F." The problem might not lie in the lesson plan, but rather the students' emaciated wallets. Timothy Ogden, the managing director of the Financial Access Initiative at New York University, explains that the lessons taught in conventional financial literacy courses might not reflect the reality that students face. The lessons tend to assume that a student's income will steadily increase over time. But if a debtor's income fluctuates wildly, then applying traditional teachings becomes an exercise in absurdity.

Further aggravating matters, some student loan companies might intentionally lead students astray, instructing them to make financially self-destructive decisions that will line the lender's pockets. As Forbes describes, in 2017, the Consumer Financial Protection Bureau sued Navient for urging students to make ill-advised forbearance requests in order to bilk them through accrued interest. It allegedly spent years omitting more affordable options.

How the textbook racket racks up money

The textbook racket makes a killing based on two simple principles: price gouging and artificial scarcity. Atlas Obscura explains that textbook publishers hike up prices and frequently printing new editions of the same book to prevent students from purchasing the previous version at a cheaper price. CBS identifies the primary source of soaring prices as textbook bundles with "access codes" set to expire at the end of the semester. That both forces students to buy them at full price and renders them unsellable after the semester.

As of 2018, the average cost of books and other course materials clocked in at over $1,200 a year, according to CBS, and an estimated 65 percent of students simply forego buying required books to cut down on expenses. However, advocates for publishers have disputed such statistics. In 2016, the Association of American Publishers (AAP) called the $1,200 figure misleading, alleging that it actually represents an estimate by financial aid offices for how much money students should budget for course materials. The association placed the figure at $650 in 2016 and predicted a decrease.

A 2019 report by Inside Higher Ed seemed to corroborate the AAP's claim. Citing a survey of more than 20,000 students, it said textbook spending has decreased over time, with students paying an average of $415 for course materials. What Inside Higher Ed leaves out is, however, is that the survey also found that on top of the $415, students shelled out $527 for "technology and school supplies." If you count school supplies and technology as part of the things you use for courses (seriously, aren't they?), the price tag jumps to $942. It's not clear if this strange distinction is related to the fact that the survey was taken by an education retail advocate. Either way, the underhanded tactics cheapen higher education at too high a cost.