Here's Who Inherited Richard Pryor's Money After He Died

One of comedy's greatest voices died in December 2005, taking with him countless jokes and observations that would never be told. But the life and long career of the late Richard Pryor made an indelible mark on comedy, on stage and in film. From his early start in the 1960s as a stage comedian who made multiple appearances on TV shows like "The Ed Sullivan Show" and "The Merv Griffin Show," Pryor honed his craft and took his act on the road, finding tremendous success as a standup comedian in Las Vegas (per Biography).

Pryor's comedy albums are the stuff of legend, earning him a staggering 10 Grammy nominations with five wins (per Grammy). His writing made its way to both the small and big screen, and his efforts in these capacities were also rewarded with a Prime Time Emmy win in 1974 for best writing in comedy-variety, variety or music on a Lily Tomlin special (per IMDb), and a Writer's Guild award for his co-screenwriting credits on the Mel Brooks film "Blazing Saddles" (via Britannica).

After a long and successful career that spanned four decades, Pryor had managed to grow a sizable estate when he died on December 10, 2005. Celebrity Net Worth estimated that the proceeds from his films, comedy tours, and other endeavors made the star worth a respectable $40 million at the time of his death. With an estate worth that much, you can imagine that settling it was something that would be nearly as controversial as Pryor's comedic subject matter.

Pryor was married a total of seven times

When many folks die, a spouse and children are attached to the estate of the deceased. Though family and debtors can make the probate process lengthy and expensive, a trust can be used to circumvent probate court, frequently keeping litigation out of the process entirely.

In Pryor's case, there were a lot of hitches that were exposed once the comedian had died. He had married a total of seven times, to five different women (he married two of them twice). He was also the father of seven children, whom he shared with six different mothers. In the conventional legal sense, a basic will would not have been appropriate for this many potential heirs, which was probably why Pryor chose to have a trust created (per the estate planning law firm Morris Hall).

But despite there being a trust filed with his attorney, its ultimate settlement would be mired in a legal battle between Pryor's widow and several of his children. While a trust is almost always a document that is not contestable, California law does allow for seven reasons why a trust could be contested in their courts. When it was revealed that Pryor's widow Jennifer was the primary beneficiary to Pryor's estate, including all name and image rights and rights to his royalties, one of Pryor's children made serious allegations against both the widow and the trust document itself. What resulted was a lengthy court battle that saw Pryor's daughter Elizabeth and his widow Jennifer duking it out in probate court and in the California Court of Appeals.

Pryor's last marriage was filed secretly

Jennifer was both Pryor's fourth and seventh wife, according to Morris Hall. Pryor had a host of health issues, one of the more serious ones being his 1986 multiple sclerosis diagnosis. By 1994, Pryor needed caregivers in his home, and he hired his then ex-wife Jennifer to manage his caregivers. Pryor also hired her to be his manager.

By the year 2000, several of Pryor's children were growing frustrated with their father's manager, alleging that she limited their access to their father. His son Richard Pryor Jr. petitioned the court for a conservatorship of Pryor, only to have the request denied by the judge. Jennifer was able to show legal documents that supported her claims that she was granted power of attorney over Pryor and that the aging comedian was well cared for.

But the legal battles were only just beginning. Pryor and Jennifer married each other again in 2001, choosing to have their marriage certificate filed confidentially with the recorder's office. This meant that their marriage was not a matter of public record. As the newlywed couple did not disclose their nuptials to Pryor's children, it probably came as a shock to them that he had named his wife as the primary beneficiary of his trust, news they didn't receive until after his death. What ensued was a series of lawsuits filed by one of Pryor's daughters, Elizabeth.

Pryor's widow ultimately wins in court

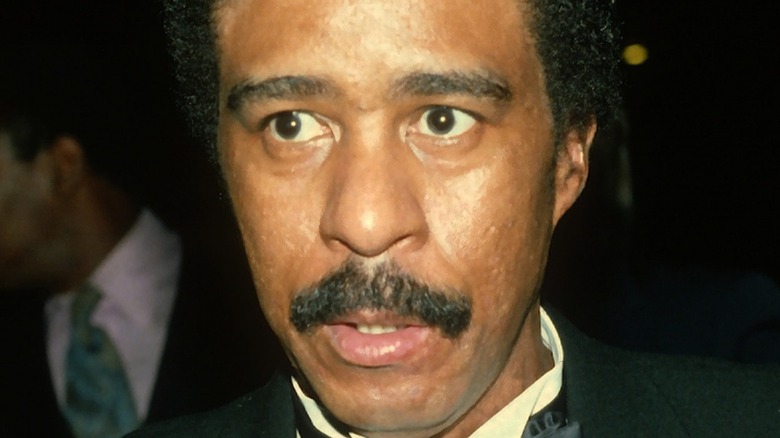

Contact Music reports that Elizabeth wished to have her father's earlier trust reinstated. The previous trust had split the estate among all of his children. She argued that he was suffering from debilitating health conditions when the latest trust was drawn up and that it was the result of Jennifer (above, in 1979) taking advantage of Pryor's weak physical and mental state at the time. She also alleged in court filings that Jennifer had committed fraud and forgery on various legal documents pertaining to the estate (via Morris Hall).

Elizabeth filed in probate court but lost decisively. This court ruled that, as Pryor's legal wife, Jennifer was entitled to whatever proceeds Pryor had granted her in his trust. Elizabeth then filed with the California Court of Appeals, hoping to gain some leverage on at least invalidating her father and Jennifer's marriage by demanding an annulment. Ultimately, the appeals court ruled in Jennifer's favor, giving Pryor's widow the final victory she needed to control the estate of the late entertainer. The court ruled that an annulment could only be filed if both parties to the marriage were alive at the time of the filing.

Elizabeth also claimed that Jennifer had broken California law by accepting gifts from Pryor as a caregiver. This, too, was ruled in Jennifer's favor, as there is a legal exception to receiving gifts in this role if you are the spouse of the person you are caring for.