The Time The US Supreme Court Ruled That Income Tax Was Illegal

Death and taxes – the timeless duality of things that never change. There are few things more likely to spark a heated debate than the subject of taxation in American society. There's a long history of disagreement on the matter, and with the exception of that little incident at the Boston Harbor on December 16 of 1773, the U.S. populace has been widely divided about whether or not the government should be receiving a portion of our hard-earned income.

According to National Archives, the 16th Amendment to the Constitution (income tax) was ratified in 1913, so if you're reading this right now and you live in the United States, odds are you've been paying some form of income tax for the majority of your life. However, prior to the 16th Amendment, there was brief period when the Supreme Court of the United Stated deemed income tax in its entirety unconstitutional (via Britannica).

Pollock v. Farmers' Loan and Trust Company, 1895

It was in 1894 that the Wilson-Gorman Tariff Act established what was called a "peacetime income tax," as Study.com reports (it also cut tariff rates). The peacetime income tax was applied to every citizen, corporation, and business entity, but a year later, after a certain Massachusetts investor took issue with something a company he held stock in was planning, things changed drastically.

According to Britannica, stockholder Charles Pollock filed a lawsuit against the Farmer's Loan and Trust Company after they declared that their business would pay the aforementioned income tax and furthermore provide an elaborate list of each and every one of its shareholders to the government. Pollock claimed that the Tariff Act was a violation of his privacy, his personal income, and — in a broader sense — Article I, section 9 of the Constitution. As it turned out, the Supreme Court shared his belief and suspended the income tax (per Oyez).

The 16th Amendment reintroduced the income tax

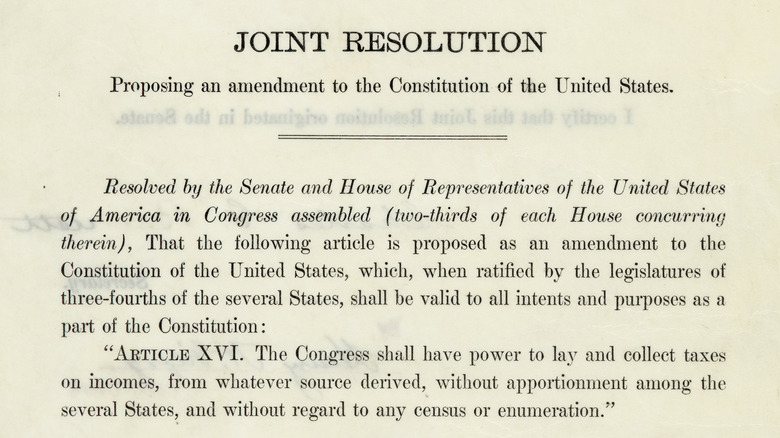

Pollock's triumph ultimately ended up being short-lived, as the 16th Amendment (1913) overturned the Supreme Court's 1895 decision. "ARTICLE XVI. The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration," it read. Once again, the income tax was applied to all citizens and market operations and has been ever since.

Even today, the subject of the 16th Amendment is a source of ongoing debate amongst legal entities and the American population as a whole. One part of the conversation asserts that the Amendment was never properly ratified and that, in the present state of things, the income tax remains unconstitutional (per Give Me Liberty). Others still argue on its behalf and stand by the legislative branch's decision to reinstate the universal collection of income, the particulars of which you can read here.