The True Story Of Willie Nelson's Album The IRS Tapes

Willie Nelson has been a force in country music for so long, he's synonymous with the genre itself. He has released multiple albums in every decade since the 1960s, starting with "And Then I Wrote" in 1962. He has won 10 Grammys and was nominated a total of 53 times. He even has a Country Music Association (CMA) award eponymously named the Willie Nelson Lifetime Achievement Award. It was first awarded to him in 2012 and has since been awarded to other country icons like Dolly Parton and Charley Pride.

What further solidifies him as a country music icon is his songwriting that went beyond his own albums. "Crazy," one of Patsy Cline's most well-known songs, was actually written by Nelson. He also wrote for Ray Price and Billy Young in the 1960s. By the 1980s, he ventured into film as an actor (via All Music). However, by the late 1980s, Nelson made headlines regarding some rather infamous aspects of his life.

Willie Nelson's manager was not paying his taxes

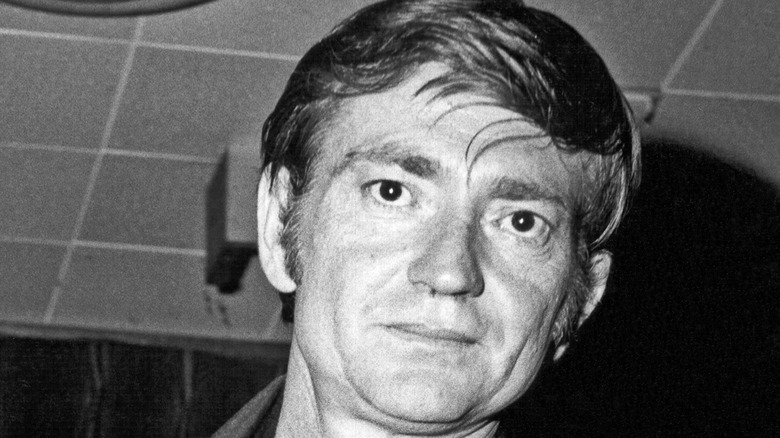

In the late 1980s, multiple financial issues began to ads up. Texas Monthly explained that In 1972, Willie Nelson began working with entertainment tycoon Neil Reshen. Reshen helped get Nelson's giant contract with Lone Star Records and managed other A-list clients such as Frank Zappa and Waylon Jennings. Things seemed to be going well as Nelson began making money and touring. However, despite what he had told Nelson, Reshen was not a lawyer or a CPA. Reshen also did not mention that he was not paying Nelson's taxes.

Apart from nearly getting busted for cocaine possession, Reshen's negligence led to Nelson owing the IRS over $2 million in unpaid back taxes by 1980. An attempt to remedy it with bunk offshore investments failed and Nelson ended up owing another $2 million (via The Musical Divide). The IRS did not let up throughout the rest of the 1980s.

The IRS bills kept adding up

Neil Reshen used tax extensions when handling Willie Nelson's money, which the Accounting Institute of Success likens to "the tax evasion equivalent of an ostrich burying its head in the sand to hide from predators." After firing Reshen, Nelson met with the Price-Waterhouse Accounting firm with his $2 million tax bill. The firm directed Nelson's money to a tax shelter in San Francisco called First Western Government Securities. The wool was again pulled over Nelson's eyes, however. The firm left the fact that this tax shelter was being questioned by the IRS out of their discussions.

Despite the fishy feeling that Nelson got from Price-Waterhouse, he invested in First Western after their representative assured Nelson's lawyer that it was in sound operation. Deeming the tax shelter illegal, the IRS sent Nelson more bills for 1980 through 1982 in the amount of $1.5 million per year. In 1990, Nelson's lawyers rightfully sued Price-Waterhouse. Even still, something had to be done to pay the charges (via Texas Monthly).

Willie Nelson was famously generous

At the time of the lawsuit against Price-Waterhouse, the IRS was asking for $16.7 million. Willie Nelson's lawyers managed to reduce this to a $6 million settlement, but it was still more than Nelson had to spare. Why is it that one of country music's biggest stars could not shell out $6 million?

The disaster of Neil Reshen and Price-Waterhouse are only partly to blame for Nelson's financial issues. Some failed investments in the cattle industry did not help either. However, the overarching issue behind it was Nelson's generosity. He only kept 10% of his earnings for himself (via The List). Upon the death of Nelson's drummer Paul English, Saving Country Music explained that English was the highest-paid drummer in the industry, as Nelson aimed to treat the whole band like family.

Unfortunately, a kind heart and playing countless benefit concerts over the years does not stop the IRS from collecting their payments. It also does not stop collectors from resorting to drastic measures.

Willie Nelson was able to protect his guitar from the IRS

In 1990, the IRS seized all of Willie Nelson's assets. The IRS raided his home and eventually auctioned it off in 1991, along with his ranch. Nelson asked his daughter to ship his prized possession — his guitar that he called Trigger — to him while he was in Hawaii to prevent it from going to auction as well (via History).

The auctions still did not cover Nelson's debts. Like a true artist, he hatched a musical plan. In 1991, he released a compilation album titled "The IRS Tapes: Who'll Buy My Memories" and shared its profits with the IRS. Perhaps the album title was a dig at the seizure of Nelson's possessions (except Trigger, of course) or the fact that money cannot buy one's memories. However, as Nelson's album showed, one can sell memories if they are memories of a world-famous music artist.

According to Forbes, Nelson's "IRS Tapes" is the only album released with an IRS revenue agreement. He wrote and recorded all of the songs himself, some new and some already known and loved. The two-disc album included 25 tracks, outtakes, and stripped-down recordings (via All Music).

Willie Nelson eventually settled his debt to the IRS

Did the plan work? Not entirely. Willie Nelson used telemarketing to promote the IRS Tapes. Half of each copy's proceeds went to the telemarketing company. Another portion went to Sony Records. Nelson kept $6 per album. $1 went to the lawsuit that Nelson waged against Price-Waterhouse. In the end, only $3 per album actually went to the IRS to pay for the millions that Nelson owed. The IRS Tapes needed to sell four million copies to eliminate Nelson's debt. Even though sales picked up once the album went into stores, it only generated $3.6 million for the IRS (via Forbes).

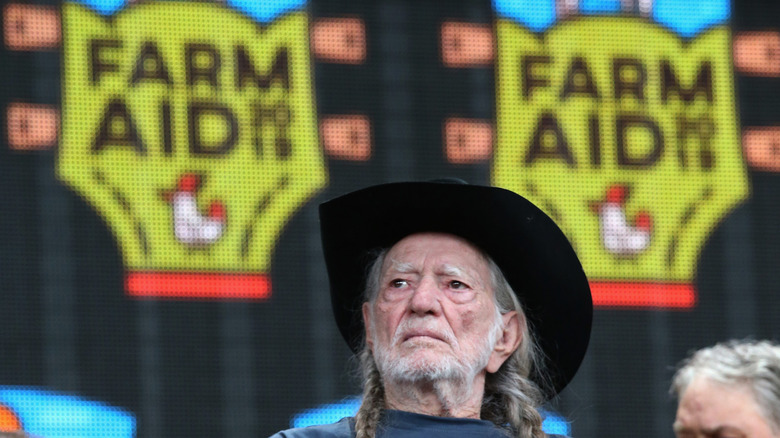

This story does still have a happy ending. Nelson's lawsuit with Price-Waterhouse, along with other projects, allowed Nelson to eventually settle the debt. History explains that fans of Nelson also stepped up throughout the ordeal, even before he released the IRS Tapes. The bidder who bought Nelson's home at the 1991 auction did so at the request of a group of farmers who wanted to thank Nelson for his annual Farm Aid benefit concerts.

Today, Nelson still records albums and holds Farm Aid every year. He has steered clear of the wrath of the IRS since settling the whopping bills in 1993.