The Panic Of 1837: The Great Depression You Didn't Learn About In School

If you were to hear mention of economic panics and depressions, there's probably a pretty good chance that your brain would immediately jump to the Great Depression. As in, the one that started with the 1929 stock market crash and would persist just about until the start of World War II. That's the one that the history books like to talk about a lot.

But here's the thing: the economy was in flux and took major hits plenty of other times throughout history. If you go back about a hundred years from the Great Depression that everyone knows about, you find yet another example of the economy crashing and people just trying to make ends meet. Back in 1837, things weren't exactly going too well in the relatively new United States of America, and the reasons why were simultaneously tied to things like personal spite and problems with international trade. It was all quite the affair, even if most modern history books fail to give it much of a mention.

Here's the story of the Panic of 1837.

The economy was doing really well beforehand

The Panic of 1837 was a definite low point when it came to the economic status of the United States. But perhaps surprisingly, in the years prior, the American economy was doing exceptionally well (at least, on the surface). Really, it's not all that different from the Great Depression; after all, the Roaring '20s seemed to show a lot of promise (via BBC), despite being the lead-up to the most famous economic low point in American history.

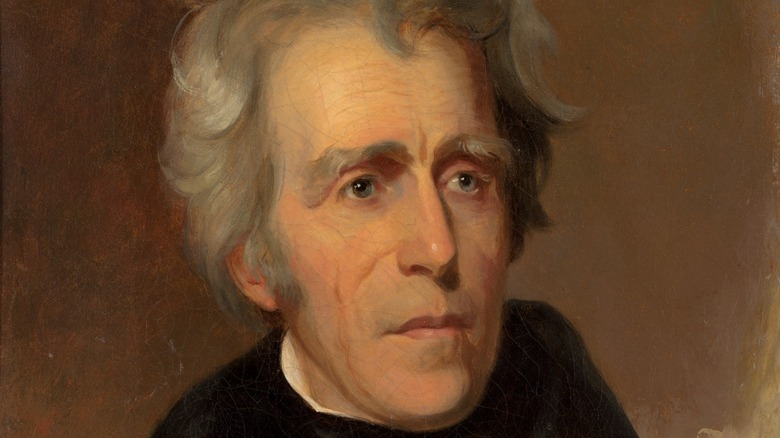

In the years before 1837, there was a surprising level of economic prosperity. Per the Lehrman Institute, by the early 1820s, the Bank of the United States (and banks in general) was no longer seen as the root cause of all financial failings, but rather, it was flourishing under the skillful leadership of Nicholas Biddle (pictured above). The exact nature of that success is fairly long and complicated, but it suffices to say that Biddle seemed to be born for his role as the president of the bank. He ushered in a period of stability as well as innovation, helping to grow both domestic and foreign trade while also standardizing the use of currency and credit.

And he wasn't the only one putting in the work. Once Andrew Jackson came to power as the president, he intended to clear the national debt, and, as explained by the Economic Historian, he did just that. Sudden, there was a surplus of money rolling around, and in the few years before everything went downhill, the country actually experienced an economic boom (via Ohio History Central).

Not everyone liked the federal bank, including Andrew Jackson

The Bank of the United States proved to be an especially controversial political point throughout early American history, with more than a couple politicians arguing against its existence (or, by the 1830s, its continued existence). According to the Lehrman Institute, banks in the early United States were easy to blame in the face of financial incidents, such as a recession in the late 1810s. Per Ohio History Central, some people just saw banks as unnecessary middlemen; why shouldn't people be able to just make large purchases themselves? Beyond that, they were usually involved in heavily speculative ventures and were run by leaders that left something to be desired. In short, the bank had made a few enemies.

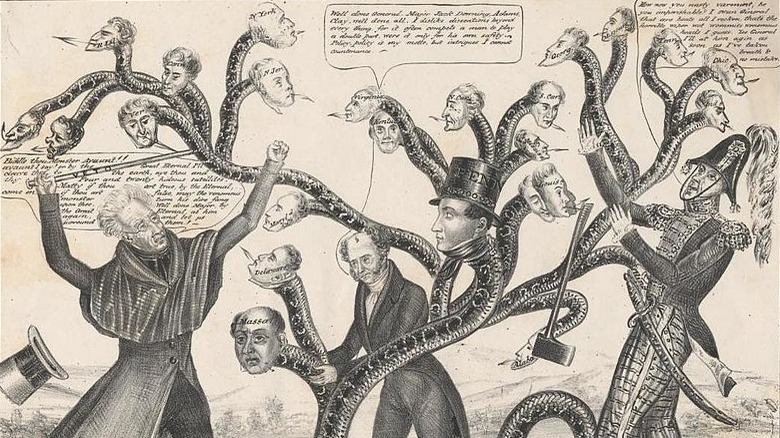

And among the Bank's enemies was future president Andrew Jackson. Seeing himself as an outsider and everyman, he painted the Bank's supporters as elite insiders – or, in other words, the enemy. Plain and simple. And that's without getting into his personal spite where banks were involved; Jackson was the kind of person who preferred hard money to credit, and he'd already been burned once by the existence of credit, a problem that took him well over a decade to solve. By the time he was planning to run for president, those feelings had turned into a vendetta: He was going to kill the federal bank.

In the end, Jackson was able to get his way. Congress moved to recharter the Bank early, in 1832, but Jackson chose to veto the bill, leaving the country without a federal bank.

The Deposit Act of 1836 and the Specie Circular

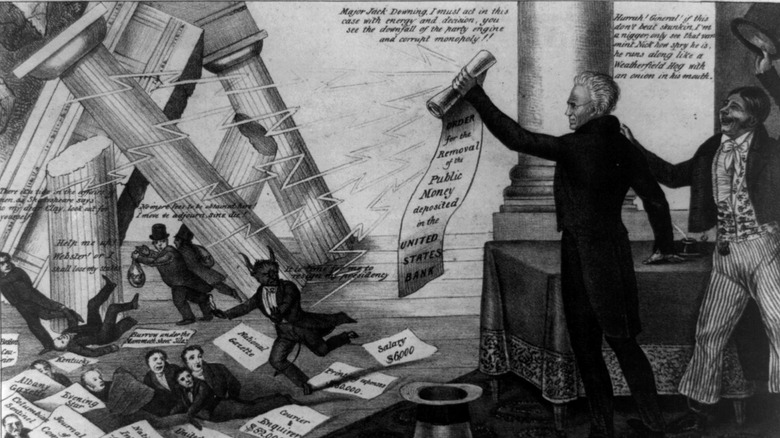

Andrew Jackson really, really didn't like banks. If there's one thing you want to take away about Jackson's whole part in this fiasco, then it probably should be that. But in more concrete terms of how he really set up the country's economy for ruin, then you can find that in a couple of federal acts passed during his time as president.

The first came as a result of Jackson getting rid of the national debt in 1835. With federal coffers for once overflowing with excess money, the Deposit Act of 1836 redistributed that wealth. According to Encyclopedia, about $30 million was moved from the U.S. Treasury to smaller state banks throughout the nation, leaving only about $5 million (in cash and actual precious metals) in federal hands. Then there was the 1836 executive order known as the Specie Circular. Per Britannica, this order essentially mandated that all land purchases be made using hard money like gold or silver (called "specie," hence the name) rather than in paper money.

So then, what did all of this ultimately mean? Well, per the Economic Historian, it meant that specie was pushed South and West, specifically away from New York City, the major economic hub of the United States (in terms of domestic trade, but also – and especially – international trade). On top of that, paper money started going out of circulation, causing deflation. While those circumstances aren't necessarily problems in a hypothetical vacuum, it did mean that should a problem arise, the nation wouldn't really be able to deal with it.

Foreign economies played a role

While the Panic of 1837 is largely considered to be an event in American history, specifically, the truth is a tad bit more complicated than that. Since the American economy is also tied to international trade, it only makes sense that those foreign economies would play some part in this whole story, right?

As explained by the Economic Historian, the Panic can be largely traced back to the way that specie was moving across the globe. In general, international trade funneled more specie into the U.S. and U.K., which set up the perfect conditions for the creation of a bubble – a period of sudden inflation, per Investopedia. (Or, put more simply, that economic term that never precedes anything good). But things continued to evolve from there when it came to those two countries, with more specie eventually flowing from the U.K. to the U.S., something that Reason Magazine specifies that the Bank of England had a hand in. As a result, the U.K. actually ended up short on specie itself, leading the Bank of England to only accept hard money payments – rather than cash – when it came to international trade.

And things only went further downhill once the Panic actually started. Not only were British merchants only accepting specie as payment, the U.K. on the whole didn't really trust the state of things in the U.S. Overall trade began to fall off as a result of that hesitation, which didn't do either country any favors when it came to mending the economy. Really, it likely just made things worse, instead.

Irresponsible banking practices

While Andrew Jackson certainly had his opinions on the Bank of the United States, seeing it as a direct challenger to the everyday person's ability to do their own business (via the Lehrman Institute), the reality was that the federal bank served a pretty important role. And that had a lot to do with regulation.

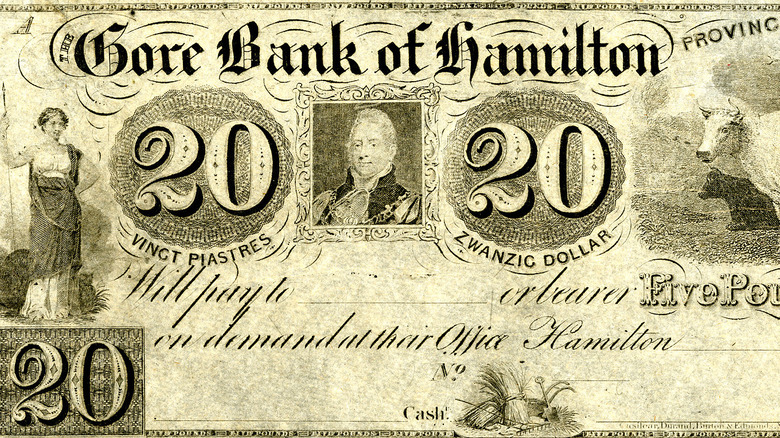

As the Economic Historian says, with federal regulation out the window, states were independently allowed to charter all the new banks that they wanted. And those new banks? They were allowed to operate with a surprising amount of freedom, issuing all the loans they wanted, but also printing their own banknotes (via the Harvard Business School Historical Collections). It probably doesn't come as a surprise that printing more money isn't exactly the best thing in most cases, but combined with the effects of the 1836 Specie Circular, all of a sudden, cash money went through some really rapid depreciation, its inherent value falling dramatically.

But things were even worse than that, because all of these risky practices also happened to coincide with an insidious real estate bubble. Various lands (many of them taken from Native Americans) began going up for sale, often with price tags asking for far more money than they were worth. Banks themselves would sometimes buy up land, only to end up losing out on their investments upon realizing that said land was overvalued and less-than-ideal for development. The speculation spelled ruin for financial institutions on more than one occasion.

The run on the banks

By May 1837, the stage was perfectly set for the American economy to completely fall to ruins. And, as it would turn out, it really wouldn't take very much for that fall to happen.

According to the Federal Reserve Bank of New York, the passing of the Specie Circular meant that everybody wanted to get their hands on specie. As in, everybody. After all, people were eager to do business, but Andrew Jackson had basically made it such that getting your hands on hard money was a prerequisite. But between the Deposit Act and the Specie Circular itself, New York banks couldn't possibly meet the demands of their customers – more people needed specie, but most of it literally wasn't located in New York anymore. By May 9, they refused to allow for any further specie withdrawals, essentially closing their doors. And that decision rippled out; in the same month, banks across the nation could also feel the strain and followed the example set by New York, refusing to honor specie withdrawals (via NCPedia). Banks tried to call in loans to remedy the problem, panicking over New York's inability to meet financial demands, but those calls ultimately made credit collapse countrywide. With banks closed and credit deemed worthless, the U.S. economy completely fell apart, a mess that wouldn't be cleaned up for years to come.

Martin Van Buren inherited all of these problems

Whenever you read about the Panic of 1837, Andrew Jackson's name appears plenty of times, and he's associated with many of the reasons why the Panic happened at all. But here's the thing: By March 1837 (via Britannica), Jackson wasn't the president anymore. He'd already passed the reins on to Martin Van Buren.

In other words, Van Buren effectively inherited a country on the brink of financial collapse, but when the banks began failing in May 1837, he proved to be just the wrong man to save the day. According to the Miller Center, he refused to lay any blame on Jackson or his policies; on the contrary, he largely seemed to agree with Jackson's general views of how the economy should work, instead choosing to vilify the banks themselves, pointing his finger at their irresponsible practices. After a few months of spreading economic despair, he called a special meeting of Congress to propose a wildly unpopular idea of setting up an independent series of subtreasuries (called the Independent Treasury).

Long story short: he made a whole lot of enemies by doing that. Different factions within his own party saw his idea as simultaneously too trusting and too suspicious of banks, while those in the opposing party couldn't overlook his inexplicable ignorance of the part that Jackson played in all of this.

The Panic wreaked havoc on businesses

Really, this part isn't that much of a shock. After all, this is a great depression that happened; the economic effects are bound to be pretty bad.

Per the Economic Historian, domestic trade fell by up to 20% – maybe not the biggest surprise, given that both banks and individuals kept trying to print more money, only leading to even more mistrust in paper currency (via Ohio History Central). Unemployment numbers also shot up at that point, rising to about 10% (though it's interesting to note that this particular statistic is somewhat odd. The U.S. was still heavily agricultural at the time, so that 10% stat is mostly relevant only to urban areas. In short, high unemployment in 1837 wasn't quite as dramatic and obvious as high unemployment in, say, 1929). Fittingly, foreign affairs also suffered, with British businesses losing out as U.S. states had to default on their loans (via Young American Republic).

As for the banks themselves? Many of them didn't survive this fiasco, with nearly half of all American banks at least partially failing, if not closing their doors entirely.

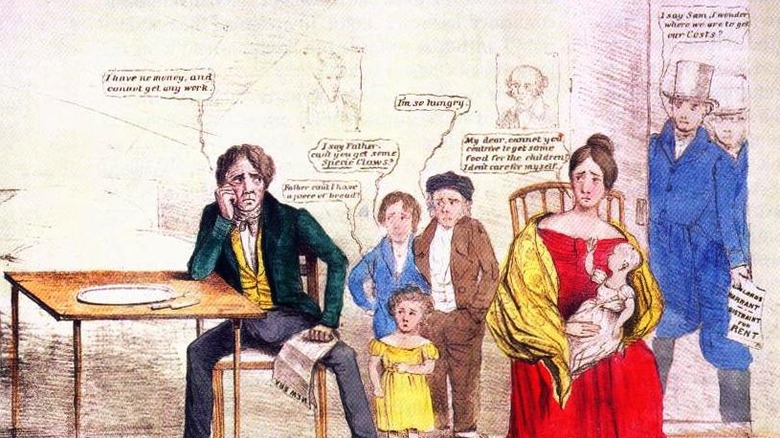

But it really hurt the people

Although the emphasis is usually on how an economic crisis affected trade and business, there are plenty more stories about how it affected everyday people. The Panic of 1837 is no different in that regard.

The Economic Historian relates that people ended up hungry. In the midst of many American citizens struggling financially, luck would have it that a bad harvest would happen to coincide with this particular catastrophe. Faced with both hunger and destitution, food riots began to erupt in major cities along the East Coast. And this wasn't an overreaction by any means – later studies would show that people born at this point in time were, on the whole, shorter than those born just a decade earlier, most likely as the result of nutritional deficits.

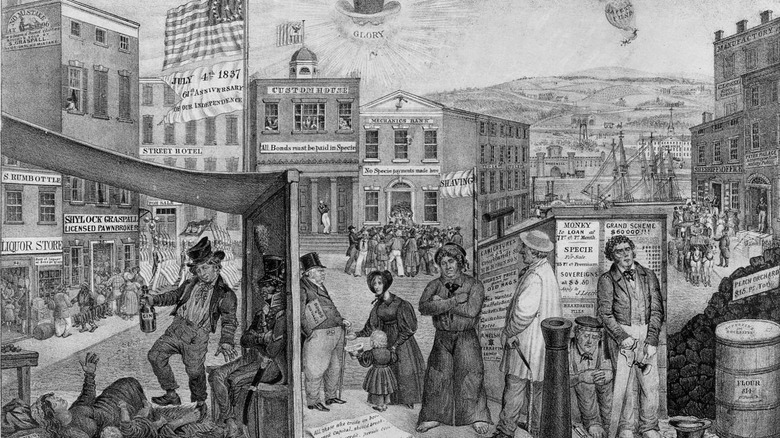

But if science isn't your thing, then art can also do the talking. A political cartoon (pictured above) published in July 1837 (via DPLA) depicts a bleak scenario. A woman and her child lay in destitution as a man stands over them, apparently drinking his sorrows away with a bottle of gin. Crowds flood around both the bank and the sheriff's office, while a board in the foreground houses a sign for a (certainly legitimate) scheme promising $60,000 as well as an advertisement by someone trying to sell old rags. A balloon labeled "safety fund" plummets from the sky, and all the while, both an almshouse and the Brideswell debtors' prison loom in the background. As a representation of New York City at the time, it vividly illustrates that the situation wasn't a good one.

How did the depression end?

The end of the financial crisis brought about by the Panic of 1837 is a bit hard to place. According to the Young American Republic, it's a topic of debate among academics, though most agree it's somewhere around 1842 or 1843. However, the Economic Historian notes that 1843 was just the point at which things started to look up again, and that real recovery wouldn't come until later.

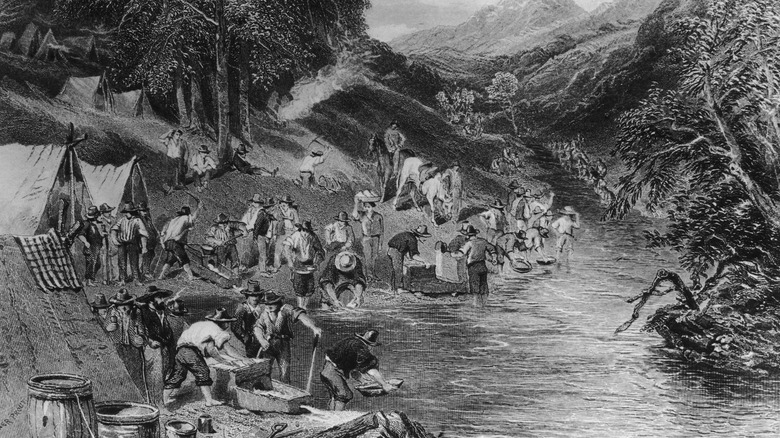

As it turned out, "later" would end up being the latter half of the 1840s. The U.S.-Mexican War would prove to be a big catalyst in all that; it raged from 1846-1848, and its conclusion paved the way for the United States to continue expanding its boundaries westward. The end of the war also coincided neatly with the California Gold Rush. Considering the fact that the Panic of 1837 was partially stirred by specie being spread too far and too thin throughout the nation, the discovery of gold deposits couldn't be more opportune. It didn't take long for banks to restock their coffers, bringing the depression to a close.

But there was another player when it came to stabilizing the economy. Per Reason Magazine, Martin Van Buren's much-maligned Independent Treasury actually made a comeback; passed during the presidency of James K. Polk, the Independent Treasury Act of 1846 helped to curb the excessive land speculation by ensuring that federal funds couldn't be placed in private banks (via History Central). Ultimately, it did stabilize the American economy pretty effectively, such that an economic crisis in Britain a year later didn't have much noticeable effect on the U.S.