Elements The World Could Run Out Of

At the current moment, there are plenty of discussions of resources that the world may be running out of. The usual suspects when it comes to those limited resources are typically things like oil, coal, or natural gas — non-renewable energy sources with controversial long-term effects on the environment. But there are other potential shortages that most people likely don't take into consideration, and which, rather ironically, might sometimes be caused by the shifts away from those non-renewable fuels.

Just what are those surprisingly limited resources? Well, they're some of the elements on the good old periodic table. Sort of strange, right? After all, it's something of an odd thought to imagine any of the universe's basic building blocks running out at some point in the future, but that's the reality of it, especially when you're looking at the scale of just the Earth. Sure, matter can't be created or destroyed, but that's the case when you're looking at the universe on the whole. Earth is another question entirely, and there's nothing in the laws of physics to ensure that the planet's stores of each element will remain easily accessible and available for human usage until the end of time.

That said, not all elements are created equal, with some being incredibly abundant and of little concern when it comes to long-term supply, while others are in potential danger of running low alarmingly soon.

Helium

At first glance, this probably seems like a completely false statement, doesn't it? It's so easy to find helium — just go to your nearest party store, and you're free to fill up all the balloons you could ever imagine. Besides that, helium is also the second-most abundant element in the entire universe. Hardly an element that seems to be in short supply.

But that logic is actually something of a problem in and of itself. When it comes to helium's remaining supply, the problem largely arises from its unique situation: It's such a light element that it can just float right off the planet. And when it's gone, there's not a whole lot that can be done to try and get it back.

Overall, the demand for the element itself has only grown over time. Of course, there's the use by everyday people looking to liven up their parties with some fun balloons, but helium also has some really interesting scientific uses. It has some special thermal properties, which, long story short, make it a really attractive candidate for application in cryogenics. Aside from that, it's proven its worth in nuclear detectors and, in a similar vein, even sees significant usage at the CERN supercollider in Switzerland. But despite all that, there's little being done to address the problem. Dirt-cheap prices encourage people to continue to buy, making it seem as if there is no supply issue, but they also discourage recycling attempts, as helium is technically recyclable, but doing so is financially unsustainable with current prices.

Phosphorus

There's likely a decent chance that phosphorus is one of those elements that you've heard of before but which has also never really stood out to you. And if that's the case, then it's also an element that's probably a lot more important than you would've expected because it's a huge player when it comes to agriculture. Given that food is undoubtedly an important thing, the fact that a major component of fertilizer might be running out isn't the most promising thing to hear.

So, what's the problem? Well, at the current moment at the very least, there aren't a whole lot of different ways to get usable phosphorus, and most of it is obtained specifically through mining. Not only that, but phosphorus is pretty heavily concentrated in the western parts of Africa and relatively few other places. To make matters even worse, the current phosphorus supply isn't used especially efficiently. A majority of it is typically lost on the way from mining to commercial availability, and it's also secreted in the form of human waste.

With the present numbers, phosphorus production could start to heavily decline within a few decades, but not all is lost. A company called Thames Water is currently working to remove the high levels of phosphorus from the Thames River in England and has proven itself very capable of doing just that. Should they also recycle that phosphorus, then that would go a long way to solving two problems at once.

Zinc

Zinc is one of those hot topics when it comes to new technologies and, more specifically, clean energy — exactly the kind of material that people would want to ensure existed for the foreseeable future. After all, adding it to steel makes that steel far more resistant to corrosion, and thus also better suited to the construction of more windmills for wind energy. The same logic applies to the use of zinc in solar cells, though it's also proven its worth in constructing safer and more efficient batteries. All very good things.

But the problem comes in the form of supply and demand. With all of these benefits of zinc, it's expected that the demand for it will rise, potentially even surpassing the available supply. And that's not even necessarily a problem for the far future; it could prove true within the coming years.

Even beyond the literal, physical supply of zinc, there's another factor to consider: the market. Putting it simply, the levels of concern over zinc's availability is heavily tied to international circumstances, making its market notably volatile. On the one hand, in 2022, both supply and demand fell, largely due to lockdowns in China putting a larger hindrance on industry than was expected. Ultimately, demand fell more than supply, relieving some of the concerns over long-term availability. But, conversely, just before those numbers came out, concerns over zinc supply were especially serious; the Russian invasion of Ukraine cut much of Europe off from the energy sources needed to refine zinc, grinding zinc production to a halt.

Hafnium

Hafnium is a pretty major player in some notably big-ticket industries, but it's probably another one of those elements you've never really heard of, just floating around as it is near the middle of the periodic table. That said, there's no doubt you're familiar with the industries that hafnium gets used in. Primarily, it's been seeing steady growth when it comes to the aerospace industry, used as a non-corrosive coating for engines, but on top of that, there's also its regular use in the control rods for nuclear power plants, as well as its growing prevalence in the semiconductor industry — nanochips and the like, essentially.

The problem? Well, that comes pretty equally in terms of both supply and demand. When it comes to demand, the increased prevalence of the semiconductor industry in the hafnium market has disrupted it hugely, as evidenced by the skyrocketing prices in the last few years alone. And the nuclear uses haven't been stagnant either; China plans to invest more heavily into nuclear energy and build more reactors, meaning more hafnium that has to go to control rods, as a large supplier pulls its stock from the global market.

But there's more than economics and politics affecting supply. Hafnium is one of those cases where there simply isn't enough to go around, because there aren't dedicated mines for it. Rather, it's only obtained as a side product of zirconium mining, and not at an impressive rate — a 1-to-50 ratio of hafnium to zirconium. Not the most comforting numbers.

Neodymium, dysprosium, and the rare earth elements

The growth of new technologies naturally leads to the demand for specific materials. And in this day and age, the need to make things smaller, cleaner, and more efficient is undoubtedly a guiding factor in the direction that technology is taking. Actually accomplishing those goals, though, has led to a reliance on rare earth elements.

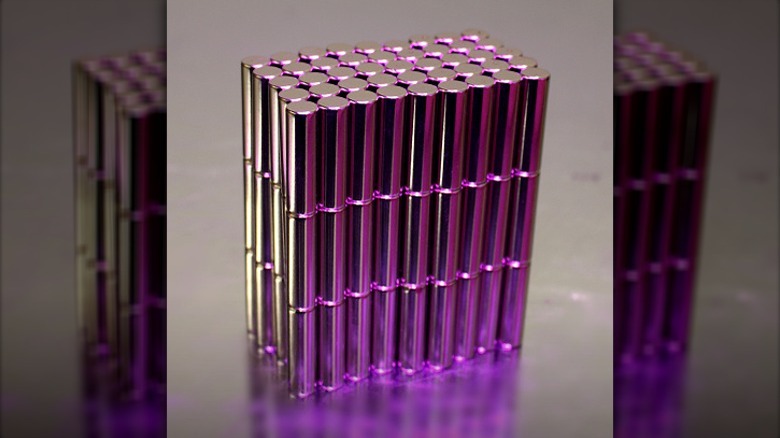

These are, for the most part, the elements that sit on the upper row of that little block floating on the bottom of the table, and of them, neodymium and dysprosium are the two very frequently mentioned. Why? They're able to make especially strong and light magnets, which can be used in anything from consumer products to wind turbines and cars. Lighter, easier to use, and oftentimes more energy efficient — all of those are great properties.

But there are a lot of problems that really should be addressed here. For one, most mining of rare earth elements takes place in China, a country that is also planning to invest more heavily in its own green energy and technology, a decision that means there will be less available for the rest of the world. Not only that, but many of these elements are chemically similar to each other and coexist in natural deposits, making them difficult to purify and separate, while also meaning that their relative supplies are inherently linked to each other. And worst of all? The properties of rare earth elements are unique; at least as of now, there's no replacement for them.

Indium

Whether you're aware of it or not, chances are that you're surrounded by products with indium at this very moment. For real, this little element is hugely important. If you've got a light on in your room somewhere, then you're seeing an alloy of indium and gallium at work in the form of LED lights. If you're reading this article on any sort of screen, then you're seeing liquid crystals that are mostly made of indium. To be even more specific, if your device of choice has a touchscreen, then that works by the magic of indium tin oxide films. And the internet that you're connected to? Its data flies down optical fibers which are, once again, made of indium.

Now, technically, there's more indium in the Earth's crust than there is silver, but it's not directly mined, instead just existing as a side-product of zinc mining. As such, it's a fairly small industry with relatively little supply, which also makes it a notably volatile one — not something that's great to hear — though, at least for the moment, it seems stable.

Planning for the future is something that should be kept in mind, however, and on that front, indium isn't doing great. While the recycling of zinc oxide coatings for phones or TVs is done during manufacturing, many of those same screens are eventually tossed in the garbage, and the indium is effectively lost. But even then, efforts have been made to try and recycle the indium in individual devices, and they've typically proven less than financially viable.

Lithium

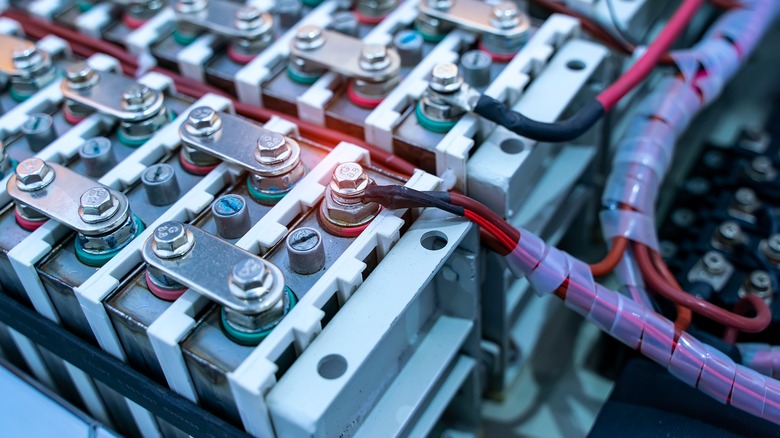

Electric vehicles are a pretty great thing — that's hard to dispute. Going all-electric is an admirable goal, and, when it comes to cars, it's a goal that's carried pretty heavily on the use of lithium-ion batteries. But have you ever wondered: Where is all that lithium coming from?

As it turns out, that's a very good question to ask, because global goals have led to plenty of concerns that available lithium supplies will soon fall far short of exponentially increasing demand. At the moment, estimates say that by 2050, the U.S. alone will need at least three times the amount of lithium currently mined by the entire world — at least if all outside factors stayed as they are. But the U.S. isn't the only player in this; estimates say that lithium needs in the E.U. will increase 60-fold between 2020 and 2050 for similar reasons. The numbers are certainly cause for concern.

But there are ways to change that, right? Finding new mines, perhaps, since lithium isn't exactly rare? Well, that's not always a guaranteed fix. One of the world's largest lithium mines was actually discovered in 2023, but its location in Iran has raised more questions than answers. After all, Iran isn't exactly on the best terms with the U.S. at the moment, so what are the geo-political implications of the discovery? Is it a powerful enough bargaining tool to shift politics, and would that shift be worthwhile?

Titanium

When it comes to the question of widespread shortages of certain elements, there are a couple of different ways to approach that question. Of course, there's the most straightforward interpretation: What would happen if people managed to take all of an element out of the Earth? But there's a slightly different variant of the thought, too. What would happen if many people's access to a particular element was cut off?

Generally speaking, titanium isn't exactly rare, ranking among the top 10 in terms of relative abundance in the Earth's crust, which seems like a promising thing, considering it's a huge part of industries ranging from aviation and aerospace to the medical field. The problem isn't in abundance, though; it's in distribution and supply. Two of the world's biggest suppliers of titanium are Russia and China, and if you know just a little about the 2020s, then you can see where the problem lies.

The COVID-19 pandemic severely handicapped Chinese exports of the metal, which is likely what prompted the E.U. to include titanium on its Critical Raw Materials list in 2020. Come 2022 with the Russian invasion of Ukraine, sanctions were on the table, but the Russian supplier of titanium managed to dodge those sanctions, simply because the aviation industry needed that titanium. It didn't sit well with most people's morals, calling into question the problem of dependency. If those one or two sources became unavailable for any reason — whether physical or political — then there just isn't an easy solution to that problem.

Platinum

It's more than likely you know what platinum is, given it's a precious metal like gold or silver. You've probably seen it around in pieces of jewelry, coins, or the like, and that might make it surprising to know that such a well-known metal is actually expected to already be in deficit in 2023.

Now, to be clear, that doesn't mean that the Earth is already completely depleted of its platinum deposits; rather, as of the mid-2020s, demand for platinum is outpacing supply — a situation that's expected to last a handful of years at the very least. But it's still a problem that should be given consideration. Essentially, platinum has had a good few applications. There are consumer products like jewelry, of course, but it also sees good use in electronics and the medical field. And, perhaps most notably, it's heavily used in the automotive industry as one of the main components of catalytic converters.

As of late, demand for platinum from the automotive industry has skyrocketed, and it's done so for a couple of potential reasons. Most likely, this is just the effect of manufacturers changing how their components are made, switching platinum in for palladium — an element which, itself, has been in low supply for years, due to both a complex mining process and a complex geo-political situation with Russia. Global supply just hasn't been able to keep up with the change, and that hasn't been helped by electrical blackouts and worker strikes in South Africa, which is the world's leading provider of platinum.

Tellurium

When it comes to tellurium, there's a lot to say about its long-term availability, but it's probably easier to start with the basics of why anyone even cares. Generally, tellurium has a number of chemical and industrial uses that rely on it making another material more robust, but the notable niche it's really settled into has to do with the solar industry. A cadmium telluride alloy has really impressive electrical properties, and a thin film of that material is an essential component in making solar cells function at all efficiently. A win for green energy, right?

But, unfortunately, tellurium has some pretty major problems when it comes to supply and availability. For one, it's just a rare element, full stop. Compared to the other elements on the periodic table, there's not a whole lot of it to be found in the Earth's crust, where it could be mined. That's not a great place to start at. To make things even more complicated, tellurium isn't directly mined since dedicated efforts aren't considered financially viable. Instead, it's almost always obtained as a side product of copper mining, which has the unfortunate side effect of leaving it completely dependent on the ups and downs of the copper market.

All the while, the demand for tellurium has been steadily rising, to the point that there have been warnings of possible shortages for years, and talks of actual deficits as 2020 rolled around. But there's no easy solution, with mining remaining restrictive and no good alternative existing to replace tellurium in its niche.